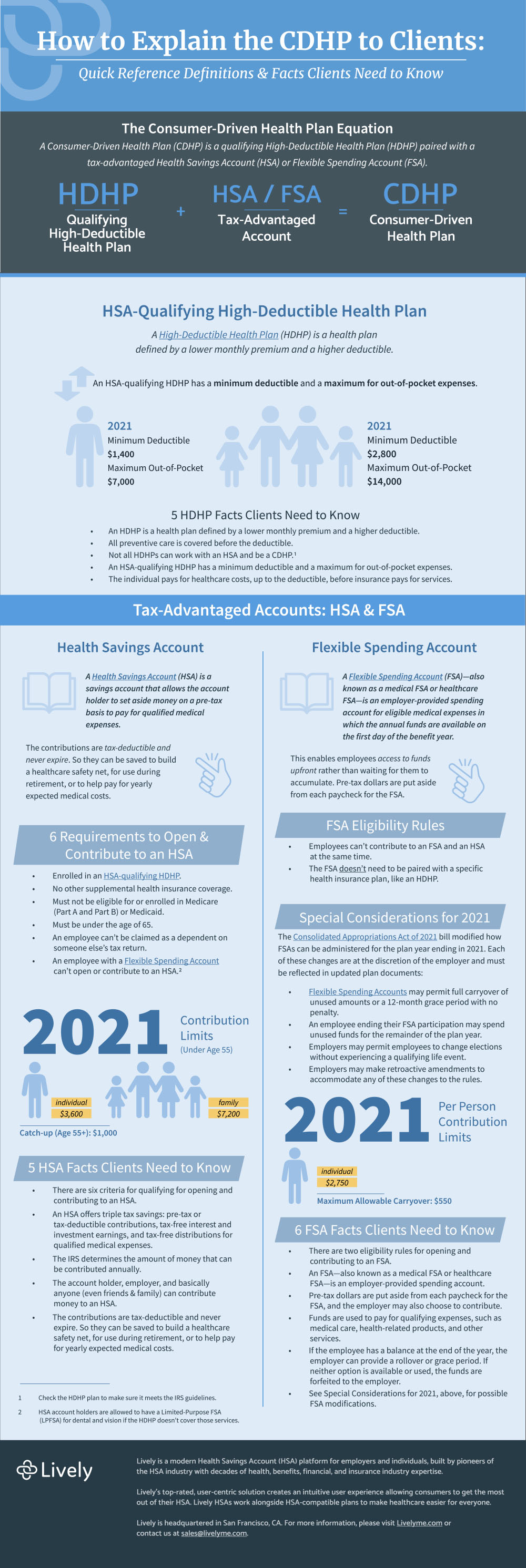

fsa health care limit 2021

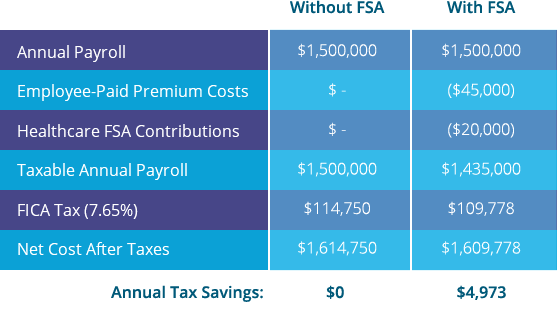

Only health care expenses incurred by yourself and the people you claim as dependents on your federal tax return can be reimbursed through the Health Care FSA. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

What Are The Hsa Contribution Limits In 2021 What Changed Goodrx

However carry over amounts have increased from 500 to 550 for any excess balance at the end of 2021 to.

. This pre-tax benefit account helps you save on eligible out-of-pocket dental and vision care expenses while taking advantage of the long-term savings power of an HSA. The monthly limit on the. 5000 2020 2021 2022 2500 2020 2021 2022 Health Care.

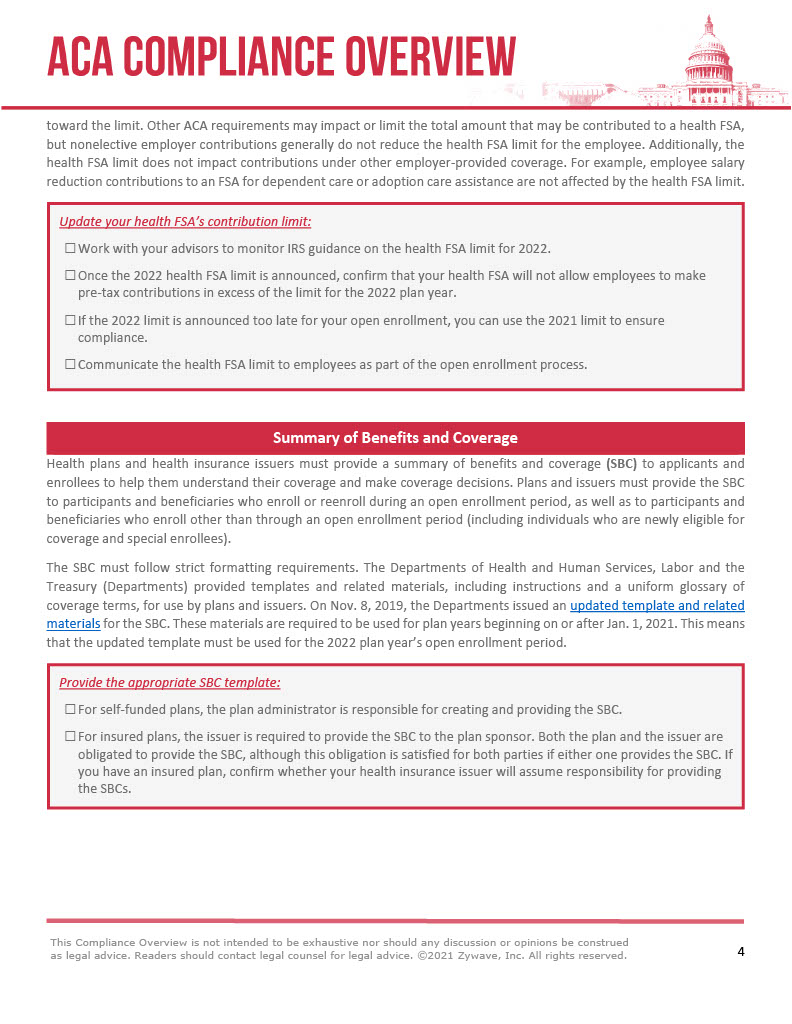

For 2021 the dollar limit on employee salary reduction contributions to health FSAs will remain at 2750. For spouses filing jointly each spouse can elect up to the health care max in the year in 2022 that. In 2021 the dependent care fsa limit was increased to 10500 for single taxpayers and married couples filing jointly and to 5250 for married individuals filing separately.

IRS Announces Health Care FSA Limit and Qualified Transportation Expense Account Monthly Limitations for 2021 Will Remain Unchanged from 2020 Limits October 26 2020 - the Internal. This is an increase of 100 from the 2021 contribution limits. Obamacare Coverage from 30Month.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to. The health FSA contribution limit will remain at 2750 for 2021. Though flexible spending account funds typically need to be spent by Dec.

The Affordable Care Act ACA imposes a dollar limit on employees salary reduction contributions to health flexible spending accounts FSAs offered under cafeteria. For health FSA plans that permit the carryover of unused amounts the maximum carryover amount for 2021 is 550 an increase of 50 from the original 2020 carryover limit. 2021 offers individuals and families additional opportunities to save for current and future health care with a Health Savings Account HSA.

HSA holders can choose to save up to 3600 for an individual and 7200 for a family HSA holders 55 and older get to save an extra 1000 which means 4600 for an individual and 8200 for a family. Easy implementation and comprehensive employee education available 247. 2020-43 set the 2021 employer contribution limit for excepted-benefit HRAs while Notice 2020-33 increased the health FSA limit on 2020 carryovers to the 2021 plan year.

Beginning January 1 2022 Health FSA contributions are limited by the IRS to 2850 each year this is a 100 increase from 2021 limit of 2750. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum. On May 12 2020 IRS released Notice 2020-33 which indexed the maximum Health Care FSA rollover 550 for plan years that begin or In 2013 the Affordable Care Act.

Youll be allowed to contribute 3600 for individual coverage for 2021 up from 3550 for 2020 or 7200 for family coverage up from 7100 for 2020. It remains at 5000 per. Ad Custom benefits solutions for your business needs.

Plus if you re. Browse Personalized Plans Enroll Today Save 60. Each spouse in the.

Health Insurance For 2022. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Ad Instantly See Prices Plans and Eligibility.

The Dependent Care FSA DCFSA maximum annual contribution limit did not change for 2022. Health and dependent care flexible spending accounts FSAs are employer-sponsored benefit. Elevate your health benefits.

31 many workers have an additional 12 months to use their 2021 contributions to cover qualifying. Child Elderly Care FSA. Qualified Transportation Fringe Benefits.

Get a free demo. Care FSA contribution limit is 5000 for single and joint filers and 2500. The HCFSALEXHCFSA carryover limit is 20 percent of the annual contribution limit.

The limit is per person.

2022 Health Fsa And Other Limits Announced Paylocity

Open Enrollment Deadlines 24hourflex

Hsa Vs Fsa What S The Difference Quick Reference Chart

Infographic How To Explain The Cdhp To Clients Lively

Top Three Reasons To Pay Attention To Cobra In 2021 Optum Financial

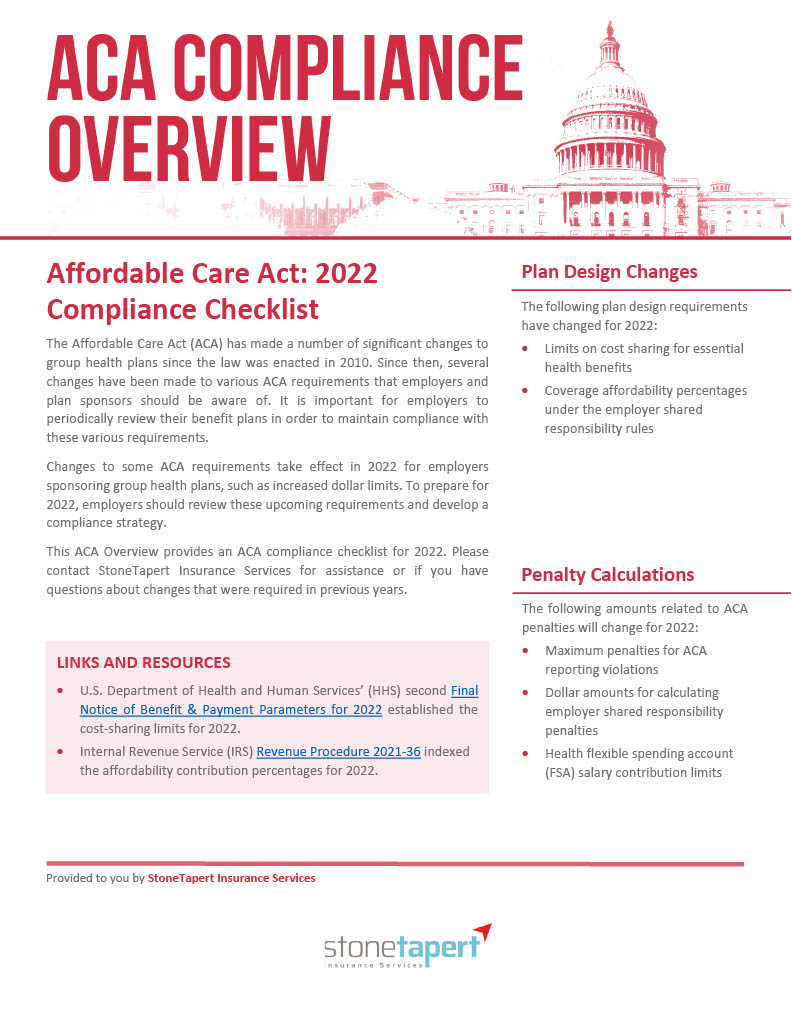

Affordable Care Act 2022 Compliance Checklist Stone Tapert

What Are The Hsa Contribution Limits In 2021 What Changed Goodrx

:max_bytes(150000):strip_icc()/4-important-steps-choosing-dental-insurance_final-ca92ac11c9564b15995b97795932b339.png)

4 Important Steps For Choosing Dental Insurance

2021 Health Savings Account And Flexible Spending Accounts Kent State University

Affordable Care Act 2022 Compliance Checklist Stone Tapert

Irs Announces 2021 Health Savings Account Contribution Limits Still Time To Make 2019 And 2020 Hsa Contributions

Hsa Vs Fsa Millennium Medical Solutions Inc Healthcare

Hre Das Hrexpress September 2021 Iowa Department Of Administrative Services

Flexible Spending Accounts University Human Resources The University Of Iowa

Flexible Spending Accounts University Human Resources The University Of Iowa

Flexible Spending Account Fsa Ameriflex

2021 Irs Rules Allow For One Time Changes To Child Care Dependent Care Fsas San Francisco Health Service System